High Yield | AAA Rated | Minimum Investment: 10k Only

National Highway Infra Trust is issuing the Non-Convertible Debentures. These NCDs are AAA/Stable by ICRA and India Ratings and Research Limited. The NCDs are issued with staggered maturity ranging from 13 to 25 years. The coupon offered by this tranche of NCD is 7.9% and effective yield is 8.05%. The NCDs are secured and redeemable in nature.

National Highways Infra Trust NCD issue – Oct-2022

Here are the issue details.

| Opening Date | 17-Oct-22 |

| Closure date | 07-Nov-22 |

| Security Type | Secured, Redeemable and Converted NCDs |

| Issue Size (Base) | Rs 750 Crores |

| Issue Size (Oversubscription) | Rs 750 Crores |

| Total Issue Size | Rs 1,500 Crores |

| Issue price | Rs 1,000 per bond |

| Face value | Rs 1,000 per bond |

| Minimum Lot size | 10 bonds and 1 bond there after |

| Tenure | 13 to 25 years |

| Interest Payment frequency | Semi-Annually |

| Listing on | Within 6 working days on BSE/NSE |

These are allotted on first come first serve basis. Hence the issue can be closed before this date if it is oversubscribed before the closure date.

What is STRPP in National Highway Infra Trust NCD?

There is major negative part in these NCDs and none of the financial websites are covering this. These are NOT regular NCDs.

Do you know that these NCD’s do not have maturity amount? There is a STRPP concept in these NCDs. STRPP which refers to Separately Transferable and Redeemable Principal Parts. Each NCD is split into STRPP-A of Rs 300, STRPP-B of Rs 300 and STRPP-C of Rs 400 totaling to Rs 1,000 overall value per NCD. Each STRPP would have different maturity dates.

STRPP-A – Tenure 13 years – Face value Rs 300

STRPP-B – Tenure 18 years – Face value Rs 300

STRPP-C – Tenure 25 years – Face value Rs 400

The maturity amount of each STRPP is paid in small parts and it would become zero as on the date of maturity. As an example for STRPP-A of the face value of Rs 300, the maturity amount would be paid in smaller pieces of Rs 50 each from the 8th year to 13th year (6 parts of Rs 50 each). On 13th year, the maturity amount of STRPP-A would be zero.

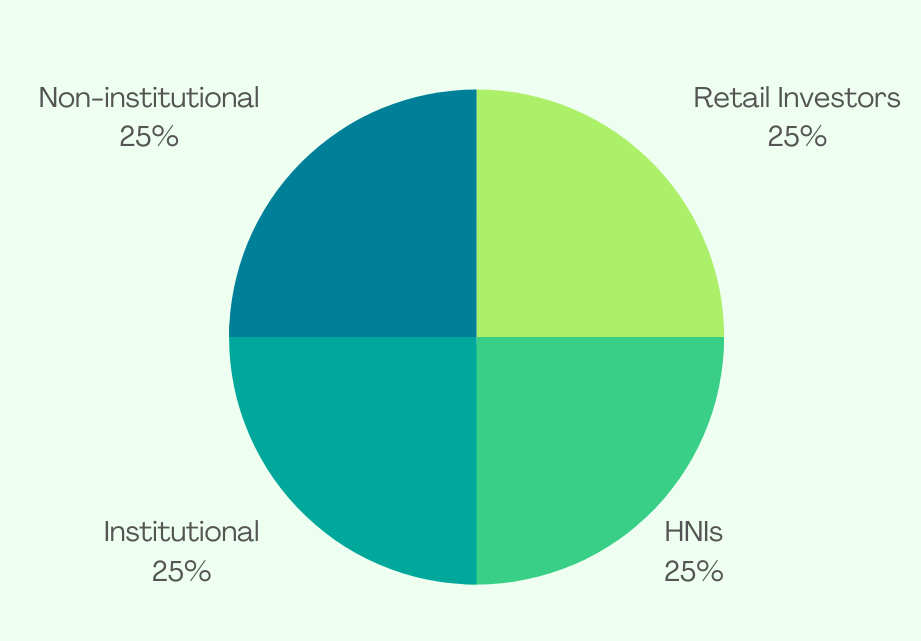

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for National Highway Infra Trust NCD-IPO.

Comments

Post a Comment